Testimony Supporting a Just DC Tax System

Dear Chairperson McDuffie and members of the Committee,

Thank you for the opportunity to submit written testimony on behalf of Bread for the City (BFC). As an organization that envisions Washington, DC, as a nurturing community, where all residents have access to the basic material resources they need for survival and growth and the prosperity of their social, emotional, and spiritual lives, BFC strongly advocates for an equitable and just DC tax system, and urges the raising of adequate revenue to support much needed economic security investments.

BFC is one of the many organizations that works on economic justice within the Fair Budget Coalition (FBC), and investments in family economic security and mobility support true community safety. As a proud member of the FBC, we stand with the Coalition in advocating for a just and inclusive District of Columbia—a place that supports strong and stable communities, that allows low-income Black and non-Black communities of color to live in dignity, and that makes it possible for all residents to achieve economic security.

In alignment with our efforts to secure a permanent guaranteed income program in DC, it was inspiring to see the introduction and the passing of the District Child Tax Credit Amendment Act of 2023. We praise Councilmember Parker for introducing the bill and applaud Chairperson McDuffie for being a continued and valued champion of economic security for DC residents. We were also pleased with the Council’s decision to increase the City’s tax revenue with an increased income tax on residents earning more than $250,000, allowing for investments in crucial programs that benefit low-income neighbors. Nearly two-thirds of all households in the District and 97 percent of those with incomes below $35,000 receiving federal CTC payments reported using those dollars to pay for basic needs like food, clothing, rent, and utilities. A robust DC CTC will likely mirror these positive impacts, setting the stage for the economic security and mobility of DC families living with the lowest incomes.

The shifting political landscape the District is facing highlights yet another need for DC Council to protect our most vulnerable neighbors and fortify local programs that provide economic security.

Taxes on wealth can help disrupt cycles of poverty.

Child poverty is associated with several adverse, life-long health and social outcomes. Some of these include reduced educational attainment compared to their peers who did not grow up in poverty, a higher likelihood of psychological distress, higher rates of cardiovascular disease, and a higher likelihood to remain in poverty as adults. The DC CTC as recommended by Councilmember Parker will reduce child poverty in the District by 5%, positively impacting over 80,000 young lives, and function as an intervention for adverse outcomes in adulthood. Further, not only is child poverty higher in DC than nationwide, but according to DC Kids Count, about 9 in 10 children living in poverty in DC are Black. A DC CTC would be just as much about economic justice as it would be about racial equity.

The Institute on Taxation and Economic Policy found that the top 5 percent of earners in DC pay a smaller share of their wealth in taxes than the other 95 percent of Washingtonians, and while the average household in DC brings in just over $100,000 a year, analysis shows that in order to live comfortably families should be bringing in about $130,000. 55 percent of DC residents, which earn between $55,000 and $399,000, give a larger share of their income to the city than the uber wealthy earning over $400,000 a year who are greenlit to continue accumulating their wealth.

Recommendations

At Bread for the City we have seen firsthand the impact that direct cash transfers can have. Since the pandemic, individually and through partnerships, Bread for the City has distributed over $56 million in direct cash transfers to members of our community, and the results are always the same: families use the cash transfers to pay for mainly housing and food costs, decreasing rates of housing and food insecurity, while boosting mental wellness. Other major uses of funds included transportation, debt reduction, spending more time with family, and professional goals like investing in small businesses.

Direct cash programs have played a significant role in increasing economic security and mobility in DC families. We trust that our clients are the experts of their own lives and use cash transfers effectively according to their situations. Similarly, an expanded DC CTC that increases the tax credit to up to $1,500 per child under 18, regardless of the parent’s immigration status, will communicate to parents in the city that their government trusts them. Prior DC Fiscal Policy Institute analysis showed that a $1,500 per child credit for those with the lowest incomes would reduce child poverty by 18%. This would be especially impactful for Black children, who are the vast majority of children (77%) living in poverty in DC.

Transformative policies like an expanded DC CTC can be funded through just and racially equitable taxes on DC’s superfluous wealth. The following are some of Just Recovery DC’s recommendations to equitably increase the City’s revenue:

- An increased tax rate on capital gains, which overwhelmingly flow to the top 1 percent;

- An increased tax rate on income above $500,000;

- An increased tax rate on income above $1 million;

- Increased taxes on homes valued at over $1.5 million

- A Business Activity Tax on for-profit organizations

Investing in our children is economic and racial justice, and supports overall community wellbeing.

Expanding the DC CTC aligns with one of the District’s core values, “to give all children, in every ward, the opportunity to thrive.” Addressing the District’s racial wealth gap through a just and equitable tax code is of utmost importance for DC children, their families, and the District at-large.

Thank you for your time and consideration of these matters,

The Economic Security Team at Bread for the City

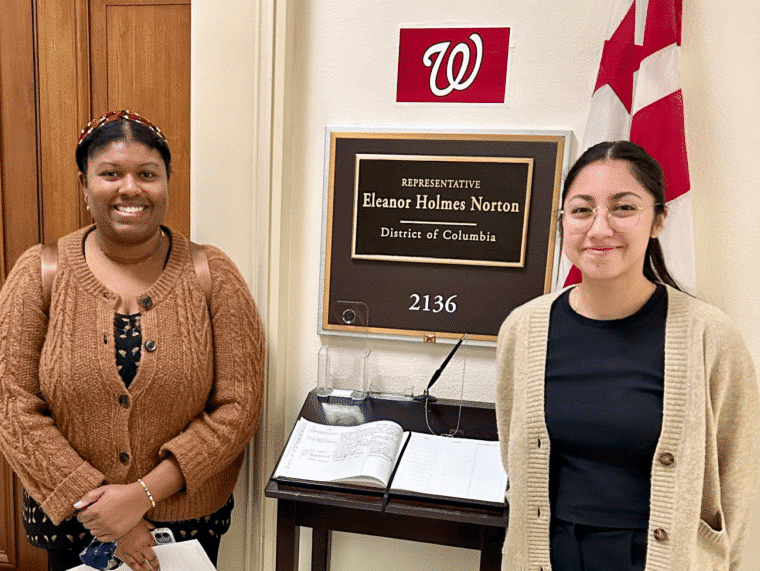

Brittany Pope, LISW

Economic Security Supervisor

Daisy Gomez Palacios

Economic Security Fellow

Williams, E. “District Child Tax Credit Bill is a Tool for Tackling Child Poverty and Should be Strengthened.” DC Fiscal Policy

Institute. January 24, 2024. https://www.dcfpi.org/all/dc-ctc-testimony-2024/

“DC Kids Count.” DC Action. 2024. https://wearedcaction.org/dc-kids-count/

Dandekar, A. Fairclough II, T. “A Majority of D.C. Voters Support a Capital Gains Tax Rate Increase When Told it Would Largely

Impact the Wealthiest D.C. Households.” Data for Progress and DC Fiscal Policy Institute. April 10, 2024.

https://www.dataforprogress.org/blog/2024/4/10/dc-voters-strongly-support-revenue-raising-policies-that-will-ensure-wealthy-h

ouseholds-and-businesses-pay-their-fair-share-in-taxes

“Who Pays? A Distributional Analysis of the Tax Systems in all 50 States.” Institute on Taxation and Economic Policy. January 2024.

https://sfo2.digitaloceanspaces.com/itep/ITEP-Who-Pays-7th-edition.pdf

Glasmeier, Amy K. “Living Wage Calculation for District of Columbia, District of Columbia.” Living Wage Calculator.

https://livingwage.mit.edu/counties/11001

“The District Can Raise Critically Needed Revenue by Taxing Wealth.” DC Fiscal Policy Institute. February 21, 2024.

The District Can Raise Critically Needed Revenue by Taxing Wealth

“DC Values Playbook.” Government of the District of Columbia Mayor Muriel Bowser.

https://mayor.dc.gov/sites/default/files/dc/sites/mayormb/publication/attachments/DC%20Values%20Playbook.pdf

“Our Platform.” Just Recover DC. 2024. https://justrecoverydc.org/our-platform